Example 2

M/s

A &S Enterprise

Trial

Balance

As

on 31st Dec 2014

Particulars

|

Debit

|

Credit

|

Stock as at 1st Jan 2014

|

28,000

|

|

Capital

|

500,000

|

|

Drawings

|

12,000

|

|

Cash

|

13,500

|

|

Bank A/c

|

47,600

|

|

Creditors A/c

|

38,300

|

|

Debtors A/c

|

45,500

|

|

Furniture A/c

|

200,000

|

|

Machinery A/c

|

325,000

|

|

Purchase A/c

|

127,000

|

|

Purchase return A/c

|

4,800

|

|

Sales A/c

|

278,000

|

|

Sales return A/c

|

5,600

|

|

Salary A/c

|

8,000

|

|

Discount A/c

|

1,500

|

|

Rent A/c

|

8,500

|

|

Insurance A/c

|

1,250

|

|

Carriage A/c

|

850

|

|

Bad debts A/c

|

1,250

|

|

Provision for bad debts A/c

|

2,150

|

|

Freight A/c

|

700

|

|

824,750

|

824,750

|

Adjustments

1.

Closing stock was valued at Rs. 34,000

2.

Outstanding Salary Rs. 2,000 and Outstanding

Rent Rs. 1,000

3.

Prepaid Insurance Rs. 250

4.

Write off Rs. 500 as further Baddebts

5.

Provide provision for bad debts at 5% on debtors

6.

Depreciate Machinery at 10% and Furniture at 5%

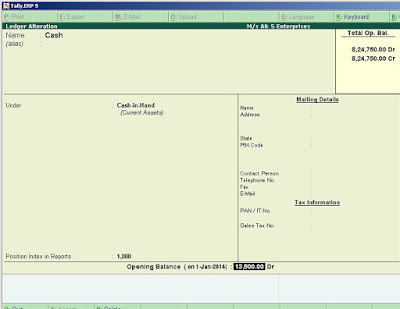

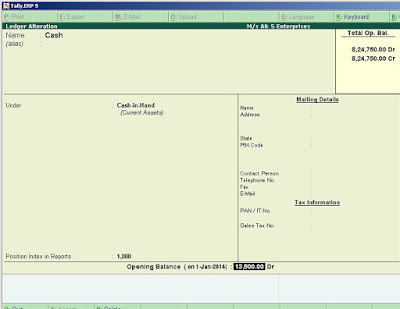

for giving the amount of cash,

in single ledger select Alter- then select cash

in opening Balance give the amount of Cash Rs. 13,500 see the Picture.

After that check the Trial Balance from Gateway of Tally- Display- Trial Balance then press F5 for ledger wise display

See the adjustments

From desk top open Tally,

Then you will get Company information window. If you get

Gateway of Tally, Press Alt + F1 to close the company

Then create a new company using the option create

company. See the fig.

Give company name and other details.

After creating company, create every ledgers from Accounts

info- Ledgers- in multi ledgers, create

Then you will get

multiple ledger creation windows. Then create every ledger except cash like the

picture given below

after this save it by pressing Ctrl+ A

in single ledger select Alter- then select cash

in opening Balance give the amount of Cash Rs. 13,500 see the Picture.

After that check the Trial Balance from Gateway of Tally- Display- Trial Balance then press F5 for ledger wise display

See the adjustments

1.

Closing stock was valued at Rs. 34,000

For giving the value of closing stock, from Gateway of Tally- Accounts info- Ledgers- Alter- Stock(which you already given), then in closing balance give company date ie 01-04-2014 and accept it by pressing enter key

2. Outstanding Salary Rs. 2,000 and Outstanding Rent Rs. 1,000

Dr. Salary A/c 1000

Cr. Outstanding Salary A/c 1000

for creating Outstanding salary Press Alt + C( it is the short cut key for secondary ledger creation) outstanding salary under the head of current liabilities

For giving the value of closing stock, from Gateway of Tally- Accounts info- Ledgers- Alter- Stock(which you already given), then in closing balance give company date ie 01-04-2014 and accept it by pressing enter key

2. Outstanding Salary Rs. 2,000 and Outstanding Rent Rs. 1,000

Outstanding expense means expense due but not paid. So it is

a liability to the business. So it

shown on the liability side if the Balance sheet and in Trading and profit or

Loss A/c it should be added to the concerned expenses. The journal entry is

that,

Expense A/c

………………………….Dr

Outstanding expense

In this example salary and rent are outstanding. So the

journal entry for this,

Salary A/c

…………………………….Dr

Outstanding Salary A/c

In Tally you should give the journal entry.

From Gateway of Tally

Accounting Voucher

Every adjustment are non cash transactions. So select

Journal voucher by pressing F7

Here in

Cr. Outstanding Salary A/c 1000

for creating Outstanding salary Press Alt + C( it is the short cut key for secondary ledger creation) outstanding salary under the head of current liabilities

Prepaid insurance Rs 250

Prepaid expanse means expense paid in advance. So it is an

asset to the business so it shown on the asset side of the balance sheet. In

the trading and profit or loss account, it will be deducted from the concerned

expense. The journal entry is that,

Prepaid expense A/c………………. Dr.

Expenses A/c

The above example,

Dr. prepaid insurance (current asset)

Cr. Insurance

For creating prepaid insurance press ALT +C and create it

under the of current asset

Write off Rs 500 as further bad debts

Bad debts refer to irrecoverable

portion of sundry debtors. That is the amount that the form has not been able

to realize from its debts. It is regarded as a loss and shown on the debit side

of the Profit& Loss A/c. In the Balance sheet it deducted from Sundry

Debtors. The journal entry is that,

Bad debts A/c…………..Dr

Sundry debtors

Provide provision for bad debts @ 5%

on sundry debtors

It is a normal course business

operation that sum debts prove irrecoverable, which means that the amount to be

realized from them becomes bad. In view of this, an attempt is made to bring in

certain element of certainty in the amount irrespect of bad debts charged every

year against income. This attempt takes the form of maintaining a provision

designed to cover the loss of bad debts is called provision for bad debts. It

created from sundry debtors. So in the balance sheet it deducted from sundry debtors.

It is an expense to the business, so it shown on the debit side of profit &

loss A/c. the journal entry is that,

Provision for bad debts A/c ………….Dr.

Sundry debtors

In the above example,

Dr Provision for bad debts A/c

Cr sundry debtors A/c

For calculating the amount of

provision, press ALT+ C on the amount column, it will be activated the

calculator area. Here you should type (45500-500)*5% then press enter key then

you will get the correct amount on the amount column

Depreciate machinery @10% and

furniture @5%

Depreciate means declining value of

asset due to wear & tear or usage or passage of time. It is business expenditure,

so it shown on the debit side of the profit or Loss A/c. in the balance sheet,

it is deducted from the concerned asset. The journal entry is that,

Depreciation A/c ……………Dr,

Fixed asset A/c

In the above example,

Dr. Depreciation on machinery A/c (under

indirect expense)

Cr. Machinery A/c

For calculating amount press ALT+C

on the amount column, then type 325000*10% then press enter key.

Depreciation on furniture

Dr. Press ALT +c depreciation on

furniture A/c press ALT +C 200000*5%

Cr. furniture A/c

Result

Gate way of tally- profit & Loss

A/c

For detailed result press ALT +F1

For close this window ESC key

Balance sheet

Gate way of tally- Balance sheet for

detailed result Press ALT +F1

If you want to check the Trail Balance

Gate way of tally –display-trail

balance

For detailed result press ALT +f1

For ledger wise display Press F4

If you want to see the journal entry-

Gate way of tally- display –day book